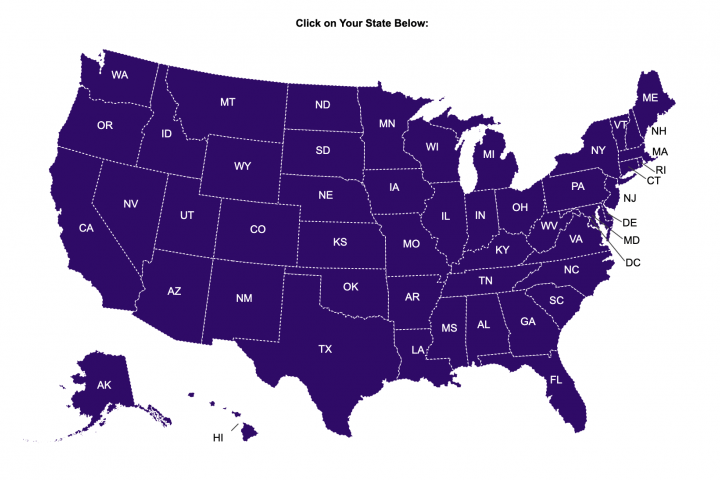

Often we need extra help navigating benefits such as Social Security/Disability, Medicaid, Medicare, Medicaid Waivers and the legal system. Disability benefits vary across the United States and each state has its own process for administering benefits. Further, the interaction of Special Need Trusts, disability based savings accounts, and employment can all impact disability and medicaid benefits. In this section, we are providing resources that can help with these issues across the lifespan.

Understanding disability benefits and appropriate ways for individuals with disabilities to save money or plan for the future, can be quite complicated. The resources in this section are designed to give an overview of some the available disability benefits and resources associated with them.

-

Special Needs Trusts - First Party or Third Party? A special needs trust is a written legal agreement that enables an individual with a disability to qualify or remain qualified for means tested government benefits, such as medicaid, SSI or even medicaid waivers. -

What is an ABLE Account and Why is it so Special? In 2014 the Achieving a Better Life Experience Act was passed. The ABLE account is a tax-advantaged savings account for individuals with disabilities. The individual with the disability is the account owner and anyone can contribute to the account – the account beneficiary, family, friends, even a Special Needs Trust. -

Special Needs Trusts - Advantages of a Pooled Trust Setting up a Third Party-Special Needs trust as part of estate planning is essential if the individual with a disability is or may be eligible for means-tested government benefits. A properly set up Third Party Trust ensures that the funds left to the individual, whether through gift or inheritance, are not considered countable assets when applying for means tested benefits -

What's the Difference Between SSI and SSDI? Many people do not know the difference between SSI and SSDI. It can be very confusing for a family or individual to understand what is available, and whether they will qualify. Very often, the recipients and their families do not even know which benefits they are receiving. But it is important to understand some basic information about government benefits. This post will focus on the two most common government benefits and give you a brief overview of how they work.

-

Podcast

Episode 8: Cerebral Palsy Health. Disability and Employment with Sarah Storck and David Stoner Individuals with disabilities have opportunities to work, receive employment training and coaching, benefits counseling and save money without losing means tested benefits. This podcast discusses...

-

Recommended Reading

Supported Decision-Making: From Justice for Jenny to Justice for All How would you feel if you weren’t allowed to make decisions about your life? What if someone had the power to tell you where to live, who to spend time with, and what to do? What if that person had...

-

Recommended Resources

Children's Waivers and More Medicaid Waivers, Katie Beckett or TEFRA are all forms of benefits that an "waive" medicaid financial restrictions for parents of children who have a developmental disability acquired prior to the age...

The ABLE account is a tax-advantaged savings account for individuals with disabilities. The individual with the disability is the account owner. Any income that is earned by the account will not be taxed if the funds in the account are used for “Qualified Disability Expenses”.